In the Union Budget 2026, the government introduced a major compliance reset aimed at small taxpayers and returning residents who may have inadvertently failed to report overseas holdings.

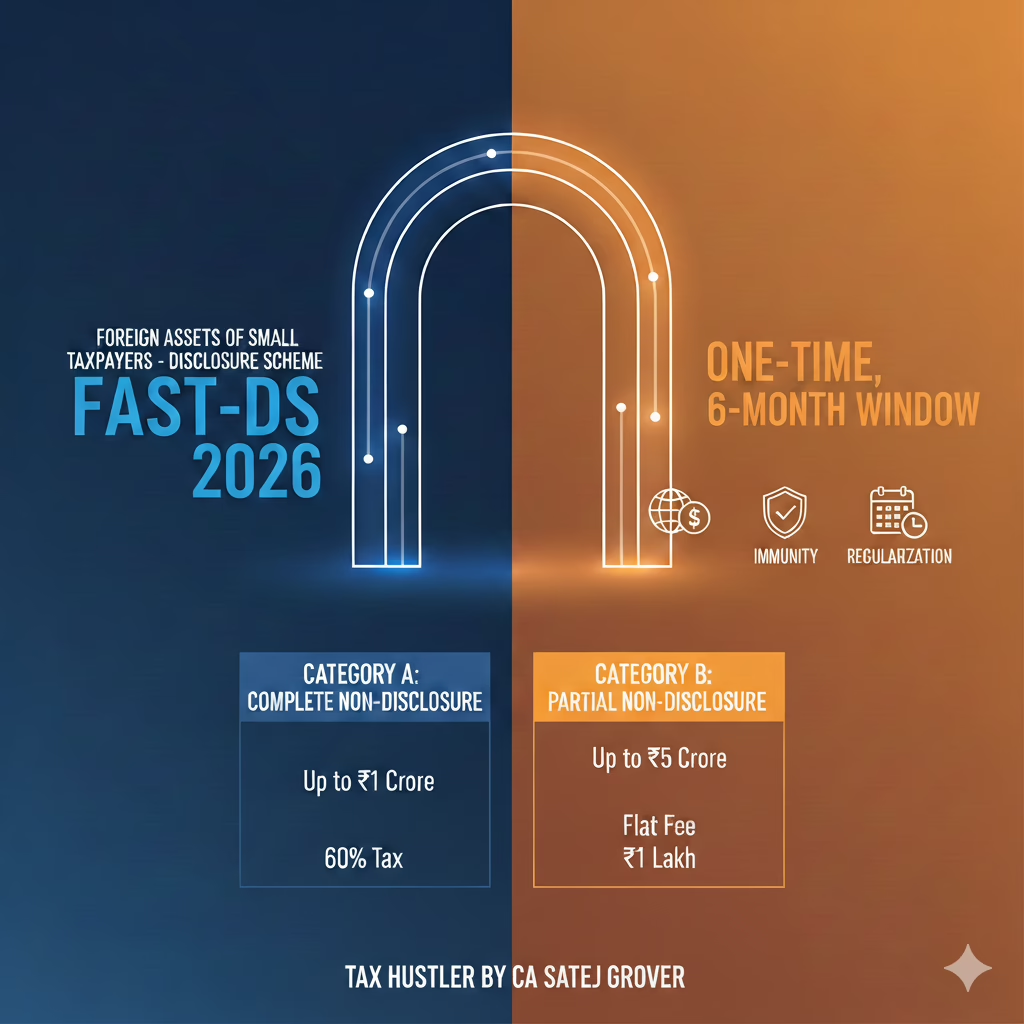

The centerpiece of these changes is the Foreign Assets of Small Taxpayers – Disclosure Scheme, 2026 (FAST-DS 2026)

- The FAST-DS 2026 Scheme

This is a one-time, six-month window for individuals to regularize their foreign asset disclosures. It specifically targets students, tech professionals with ESOPs/RSUs, and relocated NRIs who often hold dormant or low-value foreign accounts.

| Feature | Category A: Complete Non-Disclosure | Category B: Partial Non-Disclosure |

| Criteria | Overseas income or assets never disclosed. | Income was taxed/reported, but the asset was missing in Schedule FA. |

| Monetary Limit | Up to ₹1 crore (aggregate value). | Up to ₹5 crore (aggregate value). |

| Tax/Cost | 30% tax + 30% additional tax in lieu of penalty (Total 60%). | Flat fee of ₹1 lakh. |

| Benefit | Full immunity from penalty and prosecution. | Full immunity from penalty and prosecution. |

- Decriminalization for “Minor” Holdings

The Budget has significantly eased the pressure on taxpayers with very small overseas interests (such as a bank account with a few dollars left over from an old internship):

- ₹20 Lakh Threshold: No penalty or prosecution will be initiated for non-disclosure of non-immovable foreign assets if their aggregate value is less than ₹20 lakh.

- Retrospective Effect: This relief is applied retrospectively from October 1, 2024, effectively wiping the slate clean for many past minor omissions.

- Stricter Post-Window Consequences

For those who choose not to use this six-month window, the penalties under the Black Money Act remain severe:

- Tax & Penalty: A 30% tax on the asset value plus a penalty of up to 300% of the tax.

- Fixed Fine: A penalty of ₹10 lakh per asset per year for non-reporting in Schedule FA.

- Jail Time: Possible imprisonment ranging from 6 months to 7 years for willful evasion.

- Why This Matters for You

Schedule FA is Mandatory: If you are a “Resident and Ordinarily Resident” (ROR) in India, you must disclose all foreign bank accounts, shares (including RSUs/ESOPs), and signing authorities, even if they generate zero income